New Tax Risk Management Monitor

Coverage of rules on mandatory and voluntary tax disclosure, public CbC reporting and corporate sustainability reporting requirements, as well as cooperative compliance and more. Don’t let yourself be taken by surprise by new tax transparency developments and prepare ahead.

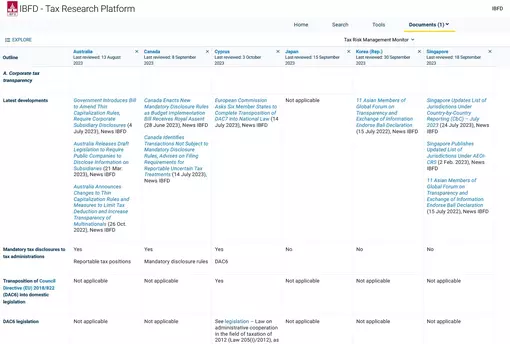

These tables available on the Tax Research Platform offer synthetized and highly practical tax risk management information on 48 jurisdictions, such as:

- mandatory & voluntary tax disclosures (e.g. EU public CbCR)

- corporate tax sustainability reporting

- corporate tax governance

- tax risk management tools

- cooperative compliance programs/tools

The tables include answers on thresholds, scope, requirements, effective dates and more, covering questions such as:

- Is there any legislation/guidance with respect to mandatory and voluntary disclosures (tax)?

- Are these mandatory disclosures public or not?

- Is there legislation/guidance with respect to mandatory or voluntary corporate tax sustainability reporting? What is the corporate tax governance around it?

The tables also include information on the tax risk management tools that are applied by the tax administration in a country, and whether a jurisdiction offers a formal cooperative compliance program and/or cooperative compliance programs/tools (including conditions).

Get a comprehensive overview of all tax transparency initiatives and developments at international, local or jurisdictional level.